JPMorgan Chase (JPM) |

|---|

| Posted: 2018-Aug-01 00:51 by Predator Research |

| Posted: 2018-Aug-02 17:03 by news bot |

| Posted: 2018-Oct-22 13:22 by news bot |

| Posted: 2023-Dec-07 15:48 by Rho |

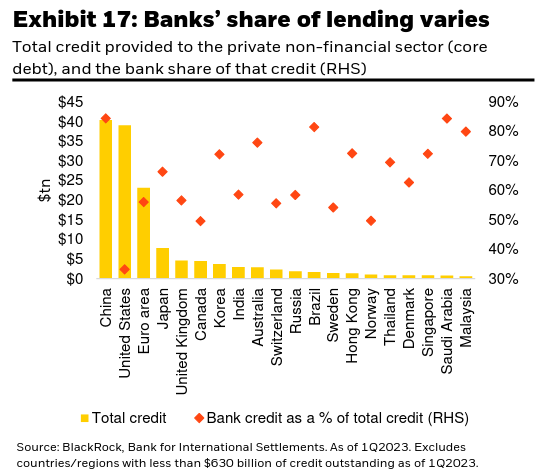

Jamie Dimon was on Capitol Hill yesterday whining about the proposed Basel III Endgame changes to bank capital requirements. His bank is having trouble selling tier 1 capital securities, but he wanted the Senate Banking Committee and everyone on main street to believe he shouldn't have to sell any more because the proposed regulation would have "predictable and harmful outcomes for the economy, markets, businesses of all sizes and American households in ways that the Federal Reserve has not studied, contemplated, or shared." If Congress passes the proposal, "mortgages and small business loans will be harder to get, especially for borrowers in lower income brackets, because the cost of originating and securing loans will rise." Dimon also predicts "lower returns for college and retirement savings, more expensive government infrastructure projects, and beverage companies paying more for their aluminum and passing that on to the consumer, leading to runaway inflation." The problem with this argument is that US banks don't actually lend much money anymore. The only loans they originate are those that can be packaged into securities and sold to private investors. Very little is held on the balance sheet. What they do hold is mostly a result of regulation requiring them to keep a portion of the loans they securitize. Check out this clever infographic from our friends at Blackrock that shows the percentage of bank credit as a percentage of total credit across the developed world. The US is dead last on the list.

The true reason regulators want the banks to raise capital is that banks like JP Morgan are sitting on a mountain of mark-to-market bond losses that they conveniently don't have to acknowledge in their financial reporting. They can ignore these losses because the banks intend to hold the securities until maturity. Which is fine, until they are forced to sell. Which is precisely what happened to SVB and First Republic back in Q1 of 2023. Jamie Dimon should stick to collecting deposits, buying treasury bonds, and STFU. Nobody on main street cares about the profitability of his bank. |

| Posted: 2025-Oct-07 15:27 by Predator Research |

Truth be told I like Jamie Dimon. What he said was stupid, but we all succumb to hubris from time to time. I read his shareholder letter earlier this year and I genuinely felt like he understood the point we made. He is a great CEO doing a tough job and I sincerely hope he is with us for many years to come. |

Donate Litecoin: "MWyP1HbzSe3P2BHgzzKGvnNUb1uj5F24UV"

Predator Trading Group